Mortgage Planning for the Year Ahead: A 2026 Roadmap from a Local Mortgage Broker

Welcome to 2026. If the last few years in the real estate market have taught us anything, it is that preparation is the ultimate currency. Whether you are looking to buy your first home in Walnut Creek, expand your investment portfolio across the Bay Area, or leverage your home equity for renovations, the landscape has evolved.

As your local Walnut Creek mortgage broker, I have seen the shifts firsthand. The “wait and see” approach is no longer a viable strategy in a competitive market like ours. Instead, successful homeowners and buyers are adopting a proactive “Mortgage Ally” mindset—treating their mortgage not just as a debt, but as a financial instrument to build wealth.

This guide is your roadmap for the year ahead. We will explore the 2026 lending environment, specific loan products like the Home Advantage 3 and DSCR Investor loans, and how to navigate the local Contra Costa County market with confidence.

The 2026 Walnut Creek Real Estate & Lending Landscape

Living and working in Walnut Creek, I see the nuances that national lenders often miss. In 2026, we are seeing a stabilization in rates compared to the volatility of previous years, but the inventory in desirable neighborhoods remains tight. This creates a specific set of challenges and opportunities:

- Competition is High: Well-priced homes in Walnut Creek and surrounding areas are still receiving multiple offers. Speed and certainty of closing are paramount.

- Equity is King: Home values in the Bay Area have continued to appreciate. For existing homeowners, this means significant tappable equity is available via HELOCs or Fixed Seconds.

- Diverse Income Streams: More borrowers are self-employed or part of the gig economy. Traditional banks often struggle here, but as a broker, I have access to Non-QM and P&L Only loans that cater specifically to this demographic.

To navigate this, you need more than a lender; you need a partner who offers honest, no-pressure advice and understands the local pulse.

Strategic Mortgage Planning for Different Goals

One size does not fit all, especially in 2026. Your strategy should align with your specific financial profile and housing goals. Here is how we break it down based on who you are.

1. For the First-Time Homebuyer: Breaking into the Market

The biggest hurdle for first-time buyers in California is often the down payment. Many assume they need 20% down to get a competitive rate or avoid mortgage insurance. In 2026, that myth is officially busted.

We are seeing incredible success with the Home Advantage 3 program. Here is why it is a game-changer for Walnut Creek buyers:

- Low Down Payment: You can get into a home with as little as 3% down.

- No Mortgage Insurance (MI): Unlike traditional FHA loans, this program features no mortgage insurance ever, which significantly lowers your monthly payment.

- Below Market Rates: It offers competitive interest rates that help with qualification ratios.

If you are currently renting and waiting to save 20%, you might be chasing a moving target as home prices rise. Schedule a call with us to run the numbers on a low-down-payment option today.

2. For Business Owners and Entrepreneurs: The “No Tax Return” Route

Walnut Creek is a hub for entrepreneurs. However, if you write off significantly on your taxes to save money, your tax returns might not reflect your true income. This often leads to rejection from big banks.

In 2026, we are heavily utilizing Profit and Loss (P&L) Only Loans and Bank Statement Loans. These allow us to qualify you based on:

- 12 or 24 months of business bank statements.

- A CPA-prepared P&L statement.

- No tax returns required.

This is the “Asset Utilization” approach that ensures your business success is rewarded with homeownership, not penalized by underwriting guidelines.

3. For Real Estate Investors: Scaling with DSCR

Investors in 2026 are moving away from income-based qualification and toward property-based qualification. The Debt Service Coverage Ratio (DSCR) loan is the premier tool for this.

With a DSCR loan, we do not look at your personal income or employment. Instead, we qualify the loan based on the cash flow of the property itself. If the rental income covers the mortgage payment (PITIA), you qualify. This allows investors to scale their portfolios without hitting a “debt-to-income” ceiling.

Refinancing in 2026: Accessing Your Wealth

If you already own a home, 2026 might be the year to restructure your debt or access capital. With home values up, you likely have significant equity. There are two smart ways to access this without touching your primary mortgage rate (especially if you locked in a low rate years ago):

Fixed Seconds

A Fixed Second Mortgage allows you to take out a lump sum of cash at a fixed interest rate. This sits in “second position” behind your main mortgage. It is ideal for large, one-time expenses like a home addition or debt consolidation.

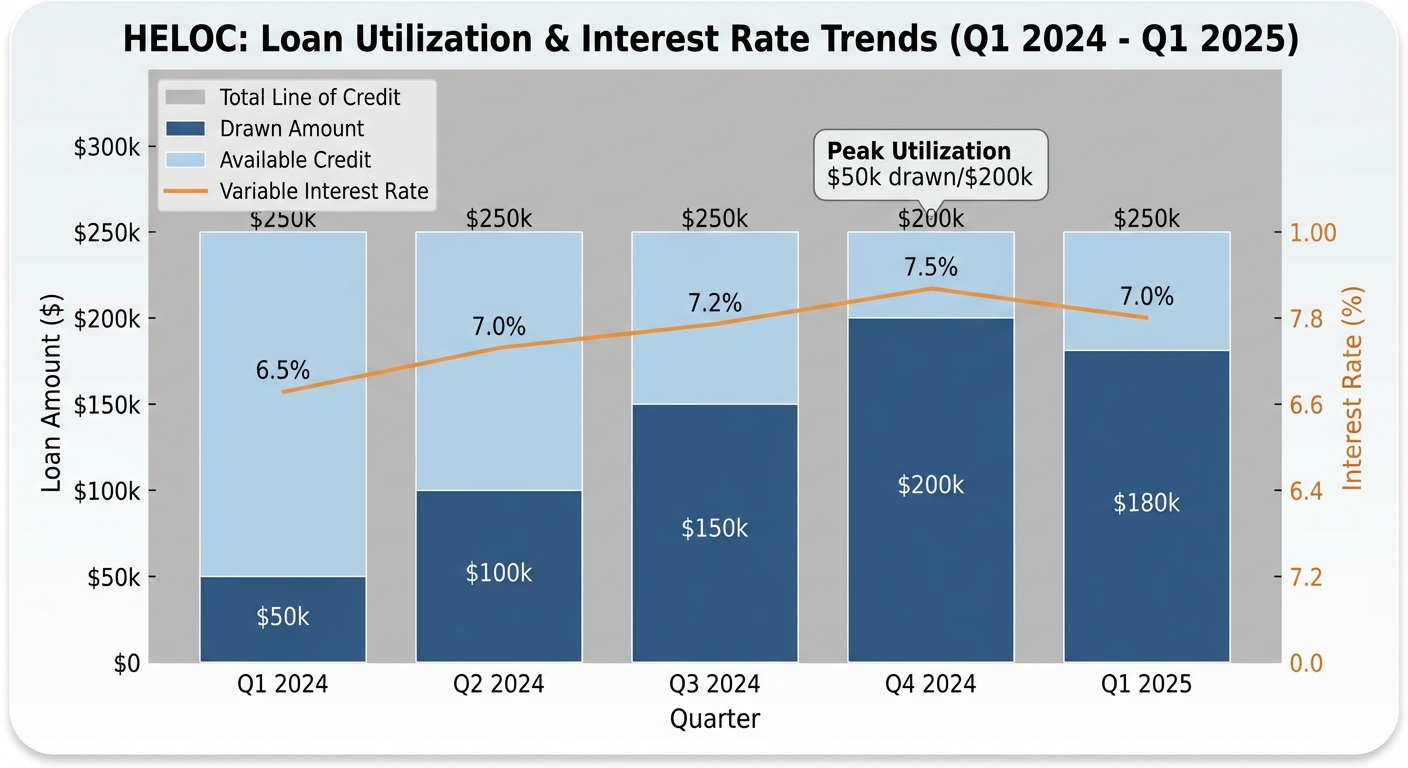

HELOC (Home Equity Line of Credit)

A HELOC gives you a revolving line of credit, similar to a credit card, secured by your home. You only pay interest on what you use. This is perfect for ongoing renovation projects or having an emergency fund ready.

Loan Option Comparison: Finding Your Fit

To help you visualize your options for 2026, here is a comparison of the loan programs we offer at Eric Rotner | Mortgage Broker:

| Loan Program | Best For | Key Benefit |

|---|---|---|

| Home Advantage 3 | First-time & Repeat Buyers | 3% Down, No Mortgage Insurance, Below Market Rates. |

| P&L / Bank Statement | Self-Employed / Business Owners | Qualify using business cash flow, no tax returns needed. |

| DSCR Investor | Real Estate Investors | Qualify based on rental income only. No personal income verification. |

| Non-QM Loans | Unique Income Situations | Flexible credit and income documentation requirements. |

| Fixed Seconds / HELOC | Homeowners with Equity | Access cash without refinancing your low-rate primary mortgage. |

Why Choose a Local Walnut Creek Broker?

In a digital age, you can get a mortgage from a call center in another time zone. But should you? Real estate is hyper-local. When you work with Eric Rotner, you are working with a top 1% originator nationwide who is deeply embedded in the Walnut Creek community.

We Finance What Others Can’t

Big banks have a “credit box.” If you don’t fit inside it, they say no. As a broker, I have access to the full spectrum of loan options. Whether it is a Bridge Loan to help you buy before you sell, or an Asset Utilization Loan for high-net-worth individuals, we find a way.

Speed Wins Offers

Your 2026 Mortgage Checklist

Ready to move forward? Here is your action plan for the coming months:

- Check Your Credit: Ensure there are no errors on your report.

- Gather Documents: Have your W-2s, bank statements, or P&L statements ready.

- Define Your Budget: Use our online tools to see what you can afford comfortably.

- Get Pre-Approved: Contact us to get a fully underwritten pre-approval, not just a pre-qualification.

- Consult on Strategy: Discuss whether a fixed rate, ARM, or buydown strategy is best for the 2026 rate environment.

Frequently Asked Questions (FAQs)

1. What are the advantages of using a mortgage broker over a bank in 2026?

Brokers like Eric Rotner have access to wholesale rates from dozens of lenders, not just one set of products. This means we can shop the market for you to find the lowest rate and the best terms. Additionally, we offer specialized products like Non-QM and DSCR loans that traditional banks typically do not provide.

2. Is the Home Advantage 3 program only for first-time buyers?

No! While it is excellent for first-time buyers, Home Advantage 3 is also available for repeat homebuyers. The primary requirements are that you intend to occupy the home as your primary residence and meet the income/credit guidelines. The 3% down payment and lack of mortgage insurance make it a superior alternative to FHA loans for many.

3. How do I qualify for a mortgage if I am self-employed?

We specialize in self-employed borrowers. Instead of tax returns (which may show a net loss due to write-offs), we can use 12-24 months of business bank statements or a Profit & Loss statement prepared by your CPA. This allows us to calculate your income based on your actual cash flow.

4. What is a DSCR loan and how does it help investors?

DSCR stands for Debt Service Coverage Ratio. It is a loan for investment properties where qualification is based solely on the property’s ability to generate rent that covers the mortgage payment. We do not look at your personal W-2 income or debt-to-income ratio, allowing you to scale your portfolio faster.

5. Can I buy a new home before selling my current one?

Yes. We offer Bridge Loans that allow you to tap into the equity of your current home to fund the down payment on your new home. This enables you to make a non-contingent offer, which is crucial in the competitive Walnut Creek market.

Ready to Plan Your 2026 Mortgage Strategy?

Whether you are looking to buy, refinance, or invest, you need a partner who puts your needs first. At Eric Rotner | Mortgage Broker, we provide transparent, no-pressure advice to help you make confident decisions.

Don’t navigate the 2026 market alone. Let’s build your roadmap together.

Call Eric Today: (925) 788-1644

Email: eric@mymortgageally.com

Start Your Application Online

Disclaimer: This blog post is for informational purposes only and does not constitute financial or legal advice. Interest rates and loan programs are subject to change without notice. All loans are subject to credit approval. Eric Rotner is a licensed mortgage broker. NMLS # [Insert NMLS Number Here]. Equal Housing Lender.